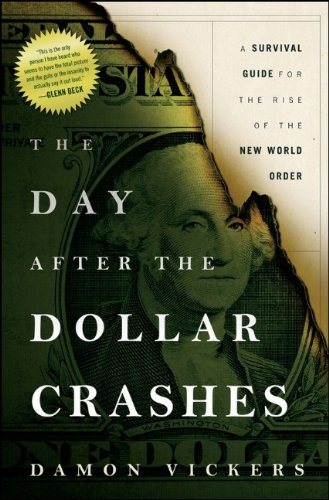

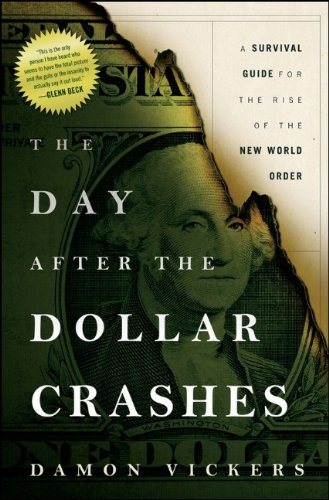

ISBN: 047091033X

Author: Damon Vickers

How to profit from the events leading up to the likely collapse of the U.S. dollar

Society is at a crossroads. Here at home and around the world, we are living in a manner that is absolutely, unconditionally, irrevocably unsustainable. The Day After the Dollar Crashes: A Survival Guide for the Rise of the New World Order outlines the kinds of events that could trigger a global economic collapse, describing in detail the events that are likely to occur just prior to, during, and immediately following such a total collapse. It also explains how investors can profit and support a sustainable future by anticipating social trends. The book

- Describes what government can do now to soften the dollar’s fall later

- Details how to lead the charge to introduce innovations and solutions to meet the inevitable challenges of new kinds of economic forces

- Reveals how to profit by changing expectations and taking action to align investments with reality

The Day After the Dollar Crashes tears away the illusions generated by politicians, media, and the financial industry to show how investors can position themselves to survive and thrive in a New World Order.

From the Author: A Fictional Timeline of Events for the Crash of the U.S. Dollar

|

| Author Damon Vickers |

10 a.m. EST Wednesday. The U.S. government is having its regular auction of U.S. Treasury notes. Here we go again begging to the world with our tin cup. Only this time the world says, “No. We aren’t going to buy any more U.S. I.O.U.s.”

3 p.m. EST Sunday. When the Asian markets open, we see a meltdown. The Asian markets are down 5 percent, then 6 percent then 7 percent in an all out free-fall. It touches off an avalanche of selling and markets around the world go into independent free-falls.

3 p.m. EST Sunday. Global currencies start to slip and are also in free fall. Gold prices rise by $300 to $400 dollars an ounce. Silver and palladium are also up as global investors convert, to put everything they have into precious metals.

9:30 a.m. EST Monday. The New York Stock Exchange (NYSE) opens and within minutes circuit breakers around the world pop under a deluge of market orders.

9:50 a.m. EST Monday. The NYSE is advised of the liquidity problems and the market shuts down. Markets around the world react with volatility in a strong down trend. Everyone starts selling bonds to raise capital, but there are few buyers. Prices plunge; yields rise.

10:10 a.m. EST Monday. Markets around the world react to the close of the NYSE with volatility in a strong down trend.

10:45 a.m. EST Monday. Several countries in Europe announce they have raised interest rates by 3 or 4 percent to make their own bonds attractive to buyers. In response, other global markets become very nervous and even less stable.

9:30 a.m. EST Tuesday. The NYSE is unable to open due to the quantity of sell orders jamming the systems.

9:45 a.m. EST Tuesday. The Federal Reserve calls an emergency meeting. The United States needs liquidity and must compete for it.

10:45 a.m. EST Tuesday. The Federal Reserve announces a hike in interest rates.

11:15 a.m. EST Tuesday. Global markets don’t like the hike in U.S. interest rates, but respond by seeking some type of footing for the short term.

11:30 a.m. EST Tuesday. The NYSE finally manages to open two hours after the opening bell. Global markets have gapped down 6 to 7 percent from Friday’s close.

12:05 p.m. EST Tuesday. Traders believe the worst is behind them.

Tuesday afternoon through Friday morning. The dollar rallies. Markets find new levels. Traders around the world are walking on eggshells and having a hard time sleeping. Global currencies are still in free fall. Gold prices continue to rise along with other precious metals as more buyers come in.

2 p.m. EST Friday. In spite of the hike in interest rates, the U.S. dollar continues to fall as global confidence continues to erode.

8 a.m. EST Saturday. The Fed reconvenes.

3 p.m. EST Sunday. The Fed announces a second interest rate hike in as many weeks. At Asian open China gets first crack at the higher yield bonds.

3:01 p.m. EST Sunday. Currency markets instantly respond as bank interest rates in Western Europe are hiked simultaneously with the U.S., but there are no buyers.

9:30 a.m. EST Monday. At the NYSE bell all hell is unleashed. Traders around the world become net sellers of equities, bonds, and western currencies. Everyone wants out at the same time. The world markets are thrown into chaos. Panic and confusion sweep the globe and all markets are in free fall.

9:42 a.m. EST Monday. Everything is jammed as the volume of selling off all distributed equities in all the global markets becomes overwhelming. The markets around the world seize up. Trading ceases.

10:11 a.m. EST Monday. On the NYSE floor, someone turns up the volume on CNN and people slowly gather around the screen to watch videos of bodies falling out of exchange headquarters in Tokyo, Singapore, Hong Kong, London, Frankfurt, Paris and Bucharest. Someone turns the sound off, but the videos keep playing.

10:28 a.m. EST Monday. On the NYSE floor, traders start to pick up their tickets. Every hand is shaking. Throughout the day shocked traders wander out of the building. Some find their way home. Others are never heard from again. Others begin to obsess about how to recoup their losses if and when the market reopens.

12:01 a.m. EST Tuesday. The IMF convenes with G20 leaders to discuss a solution to the paralyzed markets. They realize the only way to unfreeze the markets is to do a total restructure of all westernized debt in one fell swoop. This will require a complete realignment of currencies as it will likely include massive work-outs by debtor nations. The work outs will mandate that all countries submit to terms set out by a new global authority that is quickly being formed.

6 a.m. EST Tuesday. A spokeswoman for the IMF/G20 coalition holds a news conference before the New York Exchange opens. The conference is simulcast around the world in multiple languages. She assures viewers that everything is under control and that the IMF/G20 coalition will be overseeing an economic reset that will transpire in an orderly manner. She encourages people to remain calm, adding that while the temporary halt in exchange trading is awkward, everybody’s money is safe and there is no need to panic.

3:15 p.m. EST Tuesday. Around the country, panic spreads. Bank runs are reported. Looting spreads from banks and guns shops to grocery stores and supply stores. Riot squads are deployed. The National Guard is called in. Police start recording fatalities. People start firing back at the police.

Hourly updates are broadcast from the White House. The President holds a daily live news conference for selected media representatives, but takes no questions.

6:09 a.m. EST Tuesday. The IMF/G20 coalition holds a news conference that is simultaneously webcast in multiple languages. As a panel, the IMF/G20 coalition members outline the plan to restructure the global economy. They announce the establishment of a new Global Unification Exchange System (GUES) and mandate that all nations cease printing national currencies. It’s a global town hall.

11:10 a.m. EST Wednesday. The newly formed grassroots Coalition for Political Reform/USA (CPR/USA) launches a coordinated internet campaign to demand changes in America political system, specifically the elimination the Electoral College and the creation of a secure online voting system which will ensure one person, one vote and be run by volunteers across the nation.

Pretty scary stuff. Obviously, this is all conjecture. Still, it contains some possibilities that need to be considered as the U.S. dollar continues to weaken.

Pages: 85

|

Binding: Hardcover

|

| Publisher: Wiley |

Year: 2011 |